As we all watch the multiple news channels and reports coming out almost hourly, I recalled a scene from one of my favorite Pixar movies, Monsters, Inc. In this scene, a news correspondent says “It is my professional opinion that now is the time to panic!” As he raises his arms and waives them.

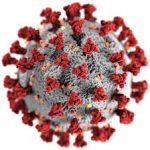

A lot is happening. We need to take the health professionals’ warnings seriously and follow what the Center for Decease Control recommends. However, we do NOT need to panic. The Coronavirus will run its course, but in the meantime we should act accordingly to prevent it from spreading faster and affecting more. It may mean we experience some unpleasant effects such as event cancellations (Fairs, sports, concerts, large gatherings), but in the end, if it prevents deaths, I am fine with that.

In our office, we have implemented procedures to reduce the transmission of any virus. Disinfecting our conference room, bathroom, waiting area and high traffic areas along with more frequent hand washing will not hurt anyone. These are things we all could and should make lifelong habits.

This is also a good time to review your estate planning documents, meaning your Will and powers of attorney. These documents should be reviewed periodically and the appropriate adjustments made. Consider reviewing your Will and estate plan in any of the following circumstances.

• Events that automatically revoke a Will: In most states, certain actions on your part automatically revoke your Will. The specific actions vary from state to state. Examples may include marriage and the birth or adoption of a child. Other actions, such as divorce, can cause property left to a former spouse to pass as though your former spouse predeceased you, which may or may not be what you intended. With every major life change, you should review your Will and consult your local attorney to see if a new Will or other changes are required.

• Marriage, divorce or death of a spouse: Marriage brings about legal relationships that can revoke or conflict with the terms of a Will made prior to the marriage. The end of a marriage requires a fresh look at your Will and, most likely, will lead you to designate different beneficiaries.

• Birth or adoption of a child: Although some states may automatically revoke your Will at the birth or adoption of a child, others may have laws that offer safeguards for children born after your Will was made. You’ll want to make sure that your Will reflects your wishes for how your property is distributed among your offspring. On the subject of offspring, you may also want to revise your Will when the grandchildren come along.

• Changed status of a beneficiary: Children grow up and get married (or divorced). A relative may become sick or disabled or may die. Events in the lives of your loved ones can have an impact on what you want to leave your beneficiaries and how you leave it.

• Moving out of state: Laws concerning Wills can differ from state to state. Plan to take a look at your Will if you will be moving out of state. Also, whenever you acquire property in another state, have your attorney review your Will to make sure it will be effective in that state.

• Changes in your assets or asset value: Over the years your wealth is likely to increase. You may have acquired assets (i.e., an investment portfolio, a business, valuable collectibles) that you did not have when you made your Will. You may have sold an asset for which you named a beneficiary when you originally made your Will. In other words, your personal financial picture is constantly changing, and your Will should be updated accordingly.

• Retirement: Major changes in your life and your financial holdings occur at retirement. You may receive a lump sum distribution from a company retirement plan, sell the family home and move to a smaller residence. Put Will review on your retirement planning checklist.

• Changed tax laws: Income, inheritance, estate, gift and generation skipping tax rules are revamped regularly. Failure to make the appropriate adjustments to your Will may mean missing tax saving opportunities.

We all tend to run from activity to activity. Take this time that has been given to us to review your estate plan without being rushed. And spend time with your family and relax. If you need to update documents, then call an attorney who focuses on estate planning for assistance.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]